Solar Benefits: USA Unlocking IRA Incentives for a Sustainable Future

The Inflation Reduction Act (IRA) marks a transformative shift in renewable energy adoption in the United States, particularly for homeowners seeking solar solutions. At IRAbenefits.com, we bridge the gap between these historic incentives and your financial goals, offering expertise that ensures maximum benefits while simplifying complex processes. Here’s a comprehensive breakdown of the IRA’s solar provisions and how they can work for you.

The Inflation Reduction Act: A Brief Overview

The IRA, enacted in 2022, represents the most substantial federal commitment to combating climate change. It provides unprecedented incentives to transition homes and businesses to renewable energy. Solar energy is at the heart of this strategy, with robust financial support to make installation affordable and accessible while driving long-term energy savings.

Clean Energy

Accelerating the adoption of clean energy.

Cost Efficient

Reducing energy costs for U.S. households.

Net Zero emissions

Supporting global sustainability targets, such as achieving Net Zero emissions by 2030.

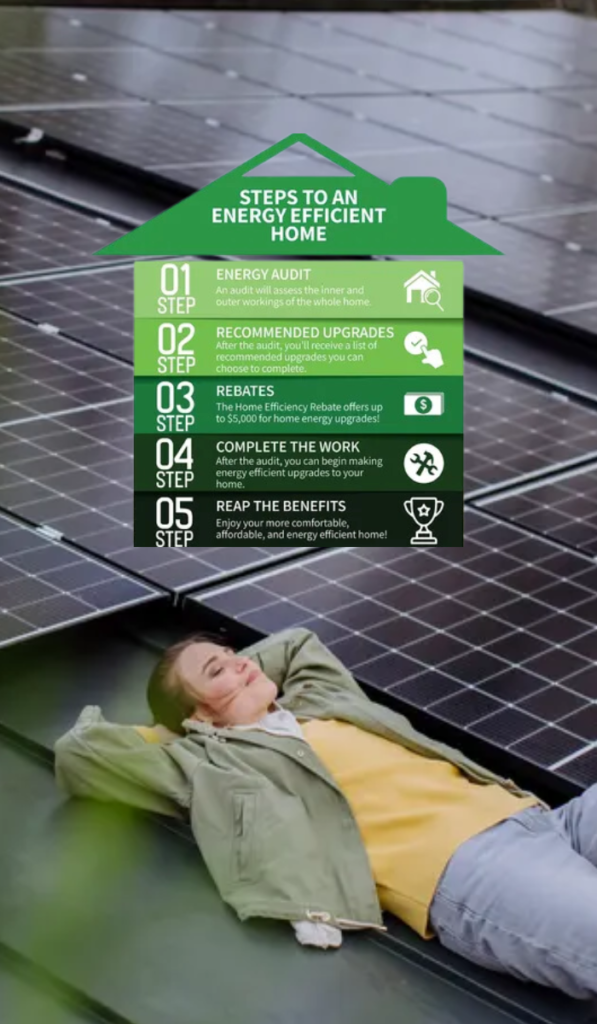

Holistic Home Efficiency Upgrades Encouraged by the IRA

IRA Reduces the Cost to Homeowner

Enhanced Federal Solar Tax Credit (ITC)

Eligible expenses include:

Solar panels and related equipment.

Energy storage solutions, such as batteries.

Professional installation and permitting fees.

Valid through 2032, with phaseouts beginning in 2033.

Battery Storage Incentives

Retroactive Claims for Recent Installations

Affordable Solar Financing

Beyond Tax Credits: Bonus Incentives and Benefits

Low-Income Community Incentives

Increased tax credits are available for solar systems installed in designated low-income areas or for projects benefiting underserved communities.

Domestic Manufacturing Bonus

Equipment made in the U.S. qualifies for additional credits, supporting local manufacturing and job creation.

Energy Banking with Net Metering

Excess energy generated by your solar system can be sold back to the grid, turning solar into an income-generating investment.

Energy Independence

Homeowners can reduce reliance on traditional energy providers, buffering against fluctuating utility prices.

Holistic Home Efficiency Upgrades Encouraged by the IRA

Improve efficiency and comfort with rebates for weatherproofing measures.

Replace old heating and cooling systems with modern heat pumps, often eligible for federal rebates.

Pair solar systems with EV chargers for additional tax credits, creating a seamless green ecosystem in your home

The Urgency to Act: Limited-Time Opportunities

While the IRA provides long-term incentives, certain benefits are time-sensitive. Bonus credits and enhanced funding may have caps or phaseout periods starting in 2032. Acting now ensures you lock in maximum savings and tax benefits.