Tax Incentives: Solar Calculator

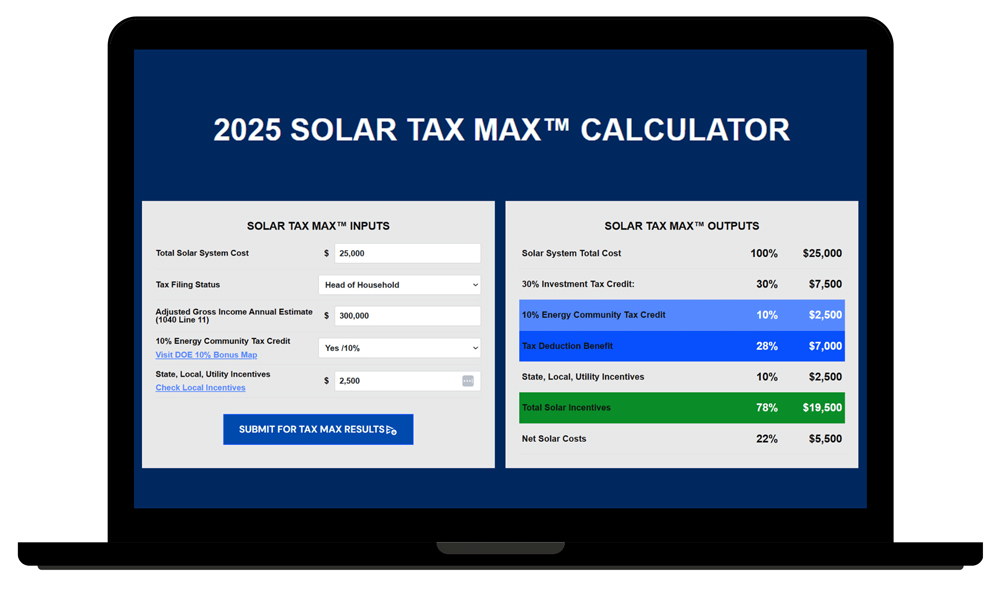

The Solar Calculator is a powerful tool designed to help you estimate the full range of tax savings available under the Inflation Reduction Act (IRA). By using this calculator, you can uncover the financial benefits of investing in solar energy, whether you’re installing a new system or retroactively claiming additional incentives for a system installed within the last three years.

Why Use the Solar Calculator?

Comprehensive Savings Insights

The calculator evaluates federal, state, and local incentives, including the 30% federal solar tax credit, energy storage bonuses, and EV charging credits.

Retroactive Savings

Eligible homeowners can claim refunds for solar installations dating back up to three years, potentially unlocking thousands in back taxes.

Transparent Pricing

Our IRA Tax Plan is offered at a fixed, no-frills price of $1,250 or 10% of your total savings, ensuring you receive the maximum benefit without hidden fees.

Tailored to Your Property

By analyzing your answers to a set of key questions, the tool provides a personalized estimate that accounts for your location, property type, and energy consumption.

How It Works

Simply fill out the form by answering straightforward questions about your home, energy use, and tax profile. Each question is carefully crafted to gather the essential details needed to calculate your savings, including:

Do you own or rent your home?

Ownership is critical for claiming federal solar tax credits

Have you installed solar panels in the past three years

If yes, you may qualify for retroactive credits and refunds.

What is your annual tax liability?

We guide you or your CPA through the filing Your eligibility for tax credits depends on having enough tax liability to offsetto ensure accurate submission.

What state is your property located in?

Incentives vary by state, and some offer additional rebates or benefits.

Why Act Now?

The IRA tax incentives are subject to change after 2025, and now is the time to secure your savings. By completing the Solar Calculator, you’ll gain access to: