Energy Community Tax Credit Bonus

The Energy Community Tax Credit Bonus is part of the IRA’s initiative to promote clean energy adoption and economic revitalization in areas historically reliant on fossil fuels. If your home or project site is located within an eligible energy community, you can enjoy additional tax incentives, making your investment in renewable energy even more cost-effective.

How much can you save?

- Production Tax Credit (PTC): An extra 10% bonus on top of the base PTC rate.

- Investment Tax Credit (ITC): An increase of 10 percentage points to the base ITC rate (e.g., from 30% to 40%).

Where Are Energy Communities?

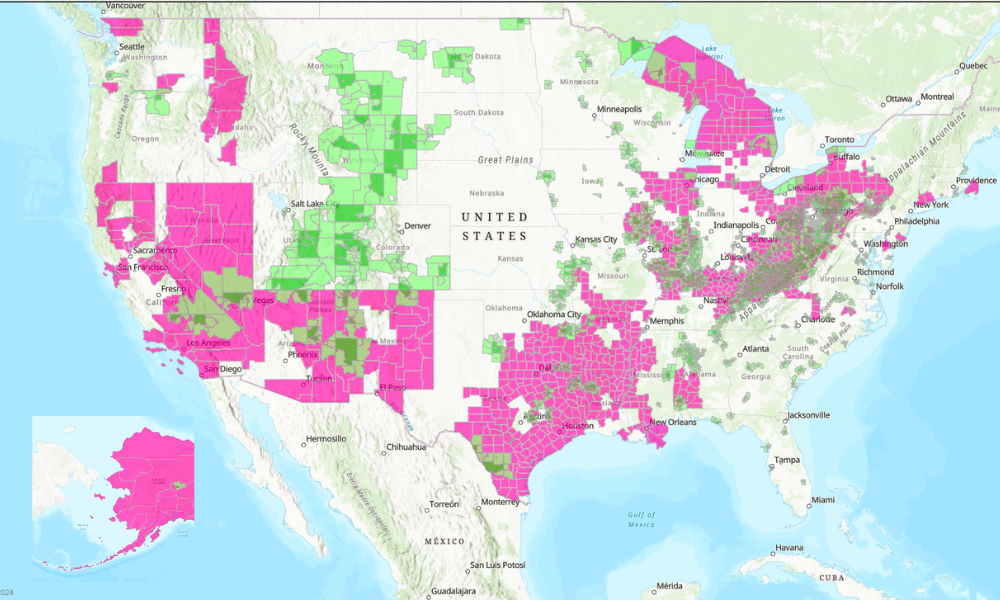

A large portion of the United States qualifies for the Energy Community Tax Credit Bonus. It depends on the State and City, as project areas are designated as energy communities. To find out if your area qualifies for the Energy Community Tax Credit Bonus by using this free map, visit the DOE 10% Bonus Map.

Why You Should Invest in Solar and Energy Efficiency in an Energy Community

Enhanced Savings

The Energy Community Tax Credit Bonus adds an extra 10% savings to the already generous federal tax credits for solar installations, battery storage systems, and energy-efficient home improvements.

Boosted ROI on Renewable Energy

Increase the value of your investment in solar panels, geothermal systems, or other sustainable products with higher tax credit rates.

Support for Local Communities

Help revitalize areas transitioning from fossil fuel reliance to cleaner energy sources, contributing to local economic growth.

Comprehensive Coverage

The bonus applies to residential, commercial, and industrial projects, ensuring wide-ranging benefits for all types of properties.

Eligible Products for the Energy Community Bonus

- Solar Panels: Save an additional 10% on top of the 30% ITC.

- Battery Storage Systems: Qualifying systems with a capacity of 3 kWh or greater are eligible for the bonus.

- Geothermal Heat Pumps: Energy-efficient heating and cooling solutions.

- Energy-Efficient Home Improvements: Insulation and air sealing materials. High-efficiency windows, doors, and skylights. Heat pumps and biomass boilers.

Steps to Claim Your Energy Community Bonus

- Verify Your Location: Use the Energy Communities Mapping Tool to confirm your project is in a qualifying area.

- Plan Your Project: Work with a solar provider or energy consultant to ensure your project meets eligibility criteria for the bonus credit.

- Meet Wage and Apprenticeship Requirements (if applicable): Projects meeting prevailing wage and apprenticeship standards may receive the maximum bonus rate.

- Claim the Credit: File IRS Form given to you by our team after purchasing the IRA Tax Plan to include the bonus in your tax return.

Why Choose IRAbenefit.com?

- Expert Consultation: Get personalized advice to maximize your tax credits and savings.

- Eligibility Assessment: We’ll help you determine if your property qualifies as an energy community.

- Streamlined Process: From planning your solar installation to filing your tax credits, we’ll guide you every step of the way.