Home Improvements

The Inflation Reduction Act (IRA) empowers homeowners to enhance their homes’ energy efficiency and sustainability through a range of tax credits and rebates. These provisions not only support efforts to reduce energy consumption and costs but also align with the U.S. goal of achieving net-zero emissions by 2050.

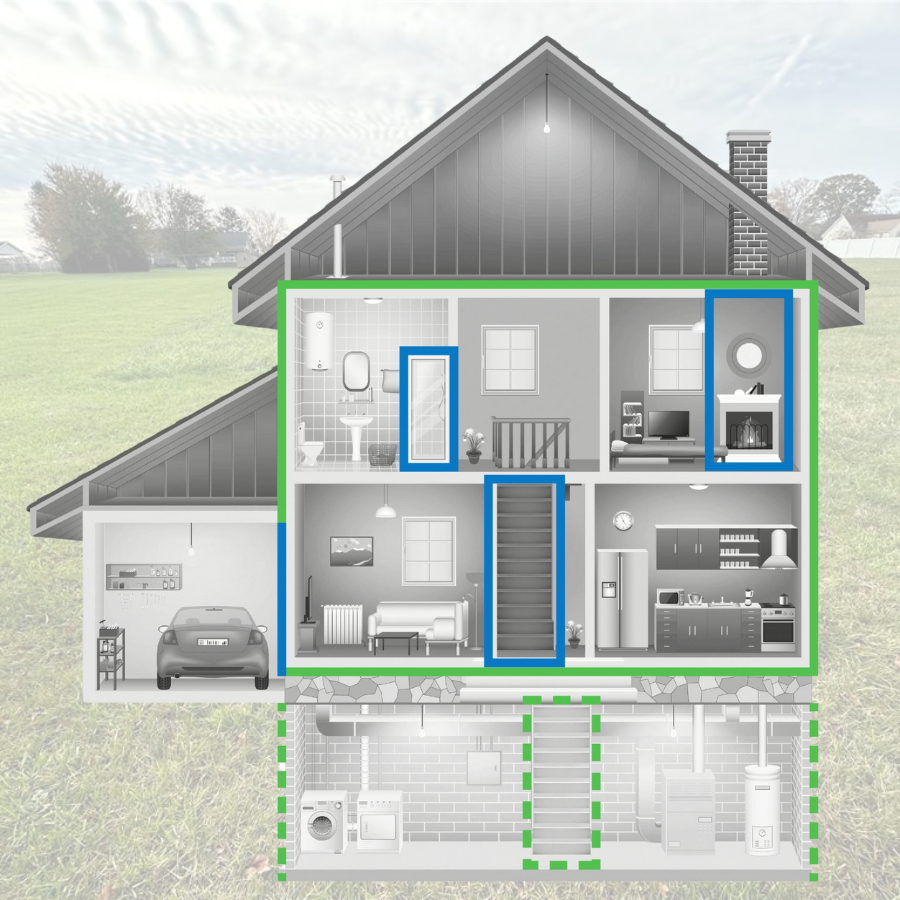

Eligible Home Improvement Projects

The IRA offers financial incentives for various types of home improvement projects. These upgrades make homes more energy-efficient, environmentally friendly, and comfortable. Some of the most impactful projects include:

Solar Energy Systems

Energy Storage: Standalone batteries are now eligible for a 30% tax credit, ensuring homeowners can store excess energy efficiently

Home Insulation and Air Sealing

Electric Vehicle (EV) Charging Stations

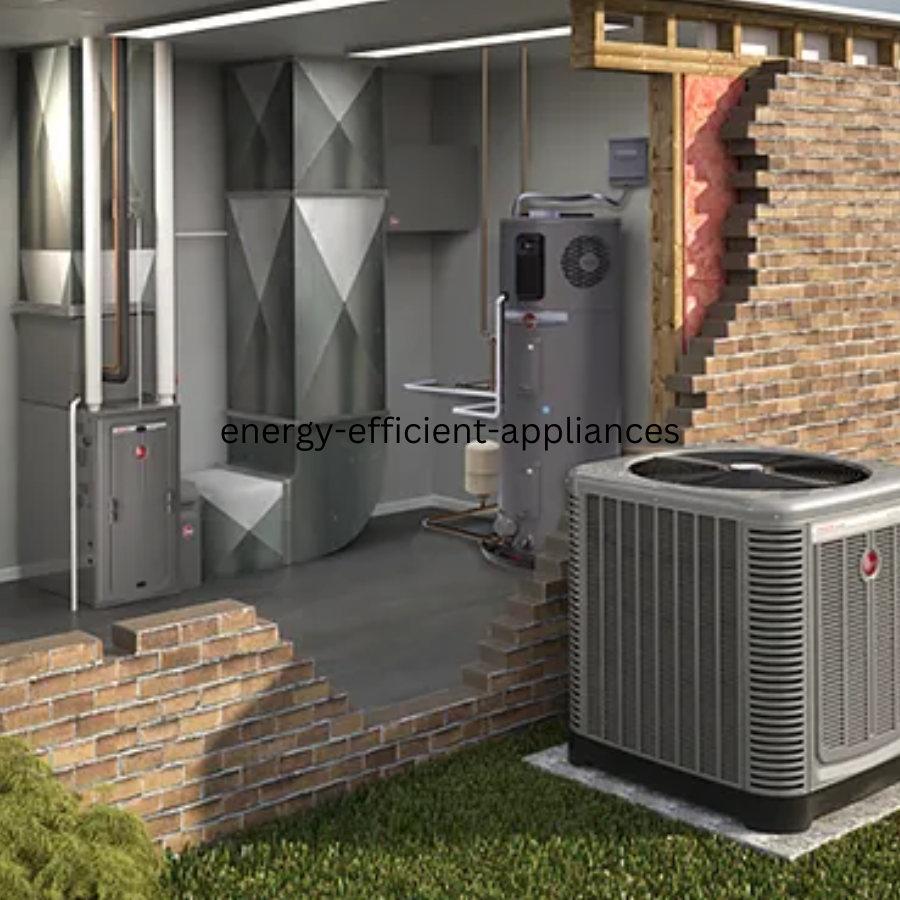

Energy-Efficient Appliances

Heat Pumps: Up to $8,000 in rebates for installing energy-efficient heat pump systems.

Windows, Doors, and Roofing

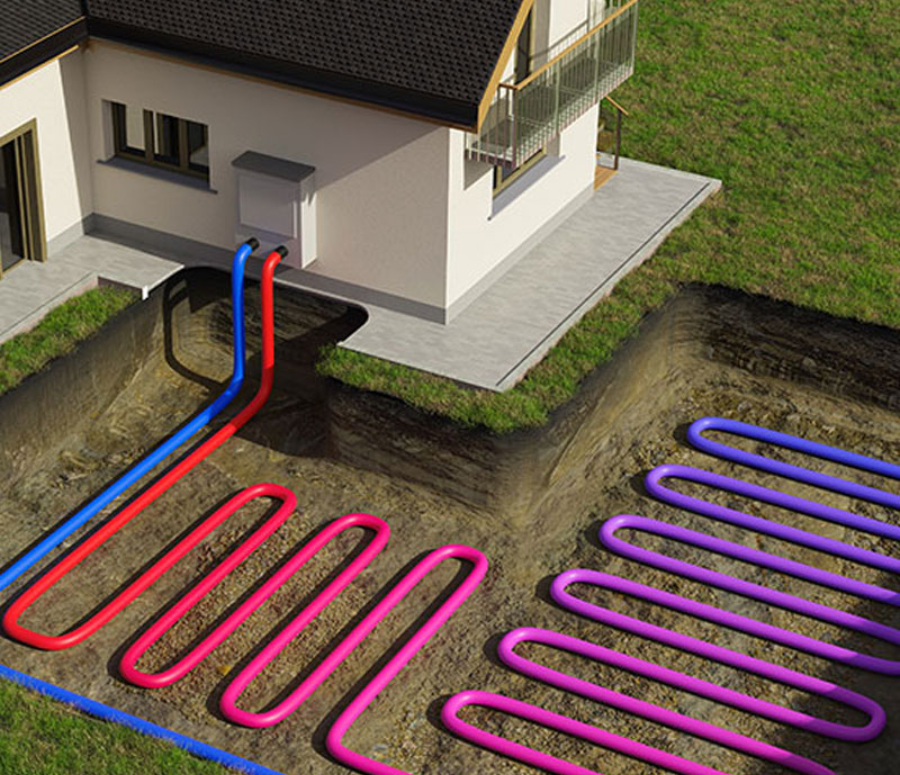

Geothermal and Renewable Systems

Financial Benefits for Homeowners

Immediate Savings

Long-Term Energy Reduction

Increased Property Value

Environmental Impact

Financial Benefits for Homeowners

Immediate Savings

Tax credits directly reduce your tax liability, lowering your costs for energy-efficient home upgrades.

Long-Term Energy Reduction

Energy-efficient homes consume less power, which translates to lower utility bills over time

Increased Property Value

Homes with modern energy-efficient systems often command higher resale prices, making these improvements a smart investment.

Environmental Impact

By adopting sustainable technologies, homeowners reduce their carbon footprint and contribute to a cleaner environment.

Stacking Incentives for Maximum Savings

In addition to federal tax credits under the IRA, many states, local governments, and utility companies offer complementary rebates and incentives. Our team of tax experts can help you combine these programs to maximize your financial benefits.

- A homeowner installs solar panels, an energy storage system, and upgrades their insulation.

- They claim the 30% federal tax credit for solar panels and battery storage and receive additional state rebates for energy-efficient insulation.

- Total savings could exceed 50% of the project costs.

Why Choose Us for Your Home Improvement Incentives?

Navigating the IRA’s provisions can be complex, but our IRA Tax Plan ensures you maximize every available benefit:

Custom Assessments

Expert Filing Assistance

No-Frills Pricing

Ready to upgrade your home and maximize your IRA benefits?

By adopting sustainable technologies, homeowners reduce their carbon footprint and contribute to a cleaner environment. Schedule a consultation to learn how we can assist with your energy-efficient home improvements.